New York University professor and global economist Nouriel Roubini testified before the U.S. Senate Committee on Banking last week, saying cryptocurrencies such as bitcoin are the mother of all scams and bubbles. He followed that assertion up by calling blockchain, the technology unpinning bitcoin, "the most over-hyped — and least useful — technology in human history."

Yesterday, Roubini doubled down on his claims in a column published on CNBC.com in which he said blockchain has promised to cure the world's ills through decentralization but is "just a ruse to separate retail investors from their hard-earned real money."

Blockchain, which can be used to create a decentralized, permissioned electronic ledger for all kinds of business transactions, "has not even improved upon the standard electronic spreadsheet, which was invented in 1979," Roubini wrote in the op-ed column.

"There is no institution under the sun – bank, corporation, non-governmental organization, or government agency – that would put its balance sheet or register of transactions, trades, and interactions with clients and suppliers on public decentralized peer-to-peer permissionless ledgers," Roubini wrote. "There is no good reason why such proprietary and highly valuable information should be recorded publicly."

Roubini is known for having been one of the few economists who predicted the 2008 financial crisis. Yet, after witnessing bitcoin's fall in value over the past year, Roubini said it and other cryptocurrencies represent the mother of all market bubbles, enticing investors, "especially folks with zero financial literacy – individuals who could not tell the difference between stocks and bonds" – into a frenzy of bitcoin and crypto buying.

Roubini's testimony before the Senate Banking Committee was "certainly entertaining and will get lot of media attention," said Vipul Goyal, an associate professor in the Computer Science Department at Carnegie Mellon University (CMU). "However, it's unclear to me if he is really a technology expert and understands the world of crypto," he added.

Goyal pointed to leading tech vendors such as Amazon, IBM, Microsoft and Oracle who are investing heavily in blockchain and have rolled out blockchain-as-a-service offerings (BaaS) that let businesses use the cloud to create permissioned blockchains for business partners to use.

Prior to becoming a professor at CMU, Goyal worked as a Microsoft researcher for seven years. He noted that while he was employed there, Microsoft's CEO, Satya Nadella, spoke multiple times about his vision for blockchain.

"Surely, these are not naive gullible people which Roubini talked about," Goyal said.

Created in 2009, a single bitcoin's value as a universal digital currency skyrocketed in 2017 and early 2018, reaching $19,666 at its apex last year. Over the past nine months, however, bitcoin's value has tumbled more than 65% to about $6,500 today. Roubini called the collapse the "crypto-apocalypse."

At the same time bitcoin's value was plummeting, the technology underpinning it was growing in popularity as a business transaction tool, enabling a "permissioned" or private electronic ledger that is both immutable and transparent to anyone authorized to view it in a group.

Blockchain has been piloted and rolled out for cross-border financial transactions, as a platform for supply chain management and as the basis for a new "trust economy." Even healthcare facilities are investigating the technology as a way to securely exchange patient healthcare information.

In some ways, blockchain is a victim of its own success, Goyal said, noting that blockchain was taken "public" too soon.

"Wall Street and financial investors started tracking it on a daily basis and that became the measure of success rather than how the underlying technology was developing," Goyal said.

Any disruptive technology takes several years to play out, become mature and find its place in the world, he said. The internet, Goyal noted, needed a decade to gain traction, and AI took even more time. Even cloud computing took several years to catch on, he said.

"I think one should be patient and give [blockchain] time to mature rather than pass a sweeping judgement without any technical understanding just based on the price of cryptocurrencies," Goyal said.

Martha Bennett, a principal analyst at Forrester Research, said that while blockchain is not unique in its ability to securely exchange data among disparate parties, other technologies lack key blockchain attributes.

For example, blockchain-based architectures provide the basis for exchanging data and automating processes in a shared infrastructure, without any single party being in charge, Bennett noted.

"This, combined with the innovation opportunities inherent in the tokenization of digital and physical assets, means that we can build new business and trust models," Bennett said via email. "However, we need to design these first; evidence to date suggests that this is going to be the hardest part."

Roubini was adamant, however, arguing that the real revolution in financial services is FinTech – and it has nothing to do with Blockchain or crypto.

"It is a revolution built on artificial intelligence, big data, and the Internet of Things," he said.

Thousands of businesses such as PayPal, Venmo and Square use FinTech to disrupt every aspect of financial intermediation involving hundreds of millions of daily users in the US. Around the globe, billions more use similar low-cost, efficient digital payment systems such as Alypay and WeChat Pay in China; UPI-based systems in India; and M-Pesa in Kenya and Africa, according to Roubini.

"And financial institutions are making precise lending decisions in seconds rather than weeks, thanks to a wealth of online data on individuals and firms," Roubini said. "With time, such data-driven improvements in credit allocation could even eliminate cyclical credit driven booms and busts."

James Wester, IDC's research director Worldwide Blockchain Strategies, said he read all 37 pages of Roubini's Senate testimony and while some of his criticisms are "slightly overstated," they're not off-base – especially the ones concerning bitcoin, blockchain and financial services.

Blockchain and other cryptocurrencies are currently less efficient than existing solutions for clearing and settling a high volume of transactions, Wester noted.

For example, Roubini accurately pointed out that because its proof of work (PoW) consensus mechanism requires nodes (servers) to complete a complicated mathematical problem as a way of authenticating new data entries, bitcoin only allows for five to seven transactions a second.

"It is secure – so far – but at the cost of no scalability," Roubini told legislators. "And since its mining is now massively centralized – as an oligopoly of miners now control its mining – its security is at risk."

Industry groups, including the Ethereum Foundation, have taken on the challenge of increasing the scalability and performance of blockchains.

"But, he [Roubini] insists on using a very narrow definition of 'blockchain' that discounts implementations and use cases that are already seeing some traction and success," Wester said via email. "For instance, he says private permissioned blockchains are 'not truly a 'blockchain.'"

Wester took the biggest exception to Roubini's implication that everyone involved in blockchain is a charlatan.

"There are certainly people who are selling blockchain as a panacea for just about everything that plagues humanity, but even within the community of technology providers, programmers and more who are involved in blockchain projects – those people are not taken seriously," Wester said.

"There are also plenty of thoughtful, smart people involved in blockchain across multiple industries who are looking to apply the technology – even as Professor Roubini defines it – to solve some interesting problems," he continued. "It might be more fruitful to engage them in good faith."

More details:

https://www.banking.senate.gov/imo/media/doc/Roubini%20Testimony%2010-11-18.pdfand

https://www.project-syndicate.org/commentary/blockchain-big-lie-by-nouriel-roubini-2018-10 Russia just put Bitcoin at the center of its economic chessboard. Earlier today, President Vladimir Putin signed a law that not only recognizes Bitcoin and other cryptocurrencies as legal property but also brings a lot of new regulations to the industry.

Russia just put Bitcoin at the center of its economic chessboard. Earlier today, President Vladimir Putin signed a law that not only recognizes Bitcoin and other cryptocurrencies as legal property but also brings a lot of new regulations to the industry. More than two hours into Republican former President Donald Trump’s World Liberty Financial launch event on X Monday night, the team behind the Trump family’s new crypto project finally unveiled a key detail: Who can buy the forthcoming tokens it plans to release, and how shares of the project will be allotted.

More than two hours into Republican former President Donald Trump’s World Liberty Financial launch event on X Monday night, the team behind the Trump family’s new crypto project finally unveiled a key detail: Who can buy the forthcoming tokens it plans to release, and how shares of the project will be allotted. Mark Scott’s wife, sitting in the spectators’ gallery just behind him, wailed uncontrollably after the New York jury passed down its verdict on November, 2019. Bank fraud — guilty. Money laundering — guilty. The 51-year-old Scott, turned out in a smart suit and expensive tan, consoled his wife over the railings. Scott used to boast to friends about earning “50 [million] by 50”, something he had achieved by laundering £300m worth of profits from the “OneCoin” cryptocurrency via layered private equity investment funds and offshore bank accounts. Now he faces up to 50 years in prison.

Mark Scott’s wife, sitting in the spectators’ gallery just behind him, wailed uncontrollably after the New York jury passed down its verdict on November, 2019. Bank fraud — guilty. Money laundering — guilty. The 51-year-old Scott, turned out in a smart suit and expensive tan, consoled his wife over the railings. Scott used to boast to friends about earning “50 [million] by 50”, something he had achieved by laundering £300m worth of profits from the “OneCoin” cryptocurrency via layered private equity investment funds and offshore bank accounts. Now he faces up to 50 years in prison. The world’s largest cryptocurrency by market cap broke above the $5,000 mark for the first time since November and has so far sustained its rally, prompting some analysts to declare an end to the so-called “crypto winter.”

The world’s largest cryptocurrency by market cap broke above the $5,000 mark for the first time since November and has so far sustained its rally, prompting some analysts to declare an end to the so-called “crypto winter.” Authorities have arrested one leader, last week on Wednesday, of a cryptocurrency project called OneCoin, which prosecutors allege was in fact a pyramid scheme rather than a functional currency. Konstantin Ignatov was arrested on a wire fraud conspiracy charge, while his older sister, Ruja Ignatova, has been indicted for money laundering, and wire and securities fraud, in a document unsealed yesterday. Ignatova is currently at large (More details:

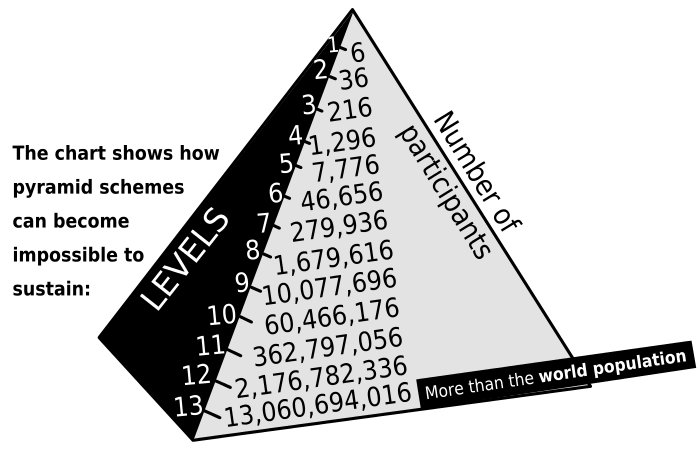

Authorities have arrested one leader, last week on Wednesday, of a cryptocurrency project called OneCoin, which prosecutors allege was in fact a pyramid scheme rather than a functional currency. Konstantin Ignatov was arrested on a wire fraud conspiracy charge, while his older sister, Ruja Ignatova, has been indicted for money laundering, and wire and securities fraud, in a document unsealed yesterday. Ignatova is currently at large (More details:  World Bank data shows that over $148 billion was sent abroad from the U.S. alone in 2017. As people leave nations gripped by hyperinflation, or simply move to look for better opportunities abroad, sending cash back home becomes a necessity. As the people in Venezuela are discovering, this can be cheaper, faster and simpler with bitcoin and other cryptocurrencies.

World Bank data shows that over $148 billion was sent abroad from the U.S. alone in 2017. As people leave nations gripped by hyperinflation, or simply move to look for better opportunities abroad, sending cash back home becomes a necessity. As the people in Venezuela are discovering, this can be cheaper, faster and simpler with bitcoin and other cryptocurrencies.  Ohio this week began accepting bitcoin as a form of tax payment from businesses, making it the first U.S. state to do so.

Ohio this week began accepting bitcoin as a form of tax payment from businesses, making it the first U.S. state to do so.

AN OLD saying holds that markets are ruled by either greed or fear. Greed once governed cryptocurrencies. The price of Bitcoin, the best-known, rose from about $900 in December 2016 to $19,000 a year later. Recently, fear has been in charge. Bitcoin’s price has fallen back to around $7,000; the prices of other cryptocurrencies, which followed it on the way up, have collapsed, too. No one knows where prices will go from here. Calling the bottom in a speculative mania is as foolish as calling the top. It is particularly hard with cryptocurrencies because, there is no sensible way to reach any particular valuation.

AN OLD saying holds that markets are ruled by either greed or fear. Greed once governed cryptocurrencies. The price of Bitcoin, the best-known, rose from about $900 in December 2016 to $19,000 a year later. Recently, fear has been in charge. Bitcoin’s price has fallen back to around $7,000; the prices of other cryptocurrencies, which followed it on the way up, have collapsed, too. No one knows where prices will go from here. Calling the bottom in a speculative mania is as foolish as calling the top. It is particularly hard with cryptocurrencies because, there is no sensible way to reach any particular valuation.